What Does Health Insurance Tampa Fl Mean?

Crashes as well as diseases can happen to any of us at any kind of time - health insurance tampa fl. Without health and wellness insurance policy, we are in charge of covering all of our medical prices, putting us at severe economic danger. A busted leg resulting from an unanticipated loss can cost nearly $8,000 in health care expenditures.

Rumored Buzz on Health Insurance Tampa Fl

However with a good insurance coverage, you may just have to pay 20% of that price, concerning $1,600. The influence of having medical insurance is also higher for extra serious diseases due to the fact that it. A three-day healthcare facility stay can set you back more than $30,000 prices that are untenable without the help of medical insurance to cover a minimum of some of the costs.

In these significant health circumstances, a medical insurance strategy's will restrict how much you invest in health and wellness treatment costs for the year. After your investing reaches this limitation, the insurance plan will certainly cover 100% of your costs for covered wellness services, no matter just how much your medical expenses complete. You'll still have to pay the regular monthly price of the plan though.

Health Insurance Tampa Fl Can Be Fun For Anyone

This plays an essential duty in the treatment and also monitoring of persistent problems as well as illnesses. Even more than 45% of the U.S. populace depends on prescription medicines to manage ailments and apprehension disease development, which aids to avoid pricey clinical issues, consisting of hospital stays. But without medical insurance, the cost of numerous prescriptions would be outrageous economically out of reach for millions of Americans.

By the very same token, a lack of health insurance policy has a reverse effect, leading to even more health issues, greater costs and also also death. Having health insurance policy can also lower your anxiety. It develops a peace-of-mind impact, helping to. At the very same time, health and wellness insurance, removing worries of being closed out of the health treatment system.

Health Insurance Tampa Fl Fundamentals Explained

There are other, much less noticeable yet crucial advantages of having healthcare. Having wellness insurance, as an example, results in less documents for the insured person. health insurance tampa fl. Health insurance keep medical records on their individuals, recording their existing therapies and medical histories. Because of this, the person might not need to hang out filling out paperwork at the factor of service.

Medical insurance can likewise. Individuals without insurance policy may feel marginalized or stigmatized. They may believe, for instance, that their absence of insurance policy is some kind of stopping working on their component, a message to culture that they can not pay for blog here health insurance or they are untrustworthy by not having it. Consequently, they may be much less likely to look for care and also treatment till their problem or disease has actually proceeded to a critical point.

Facts About Health Insurance Tampa Fl Uncovered

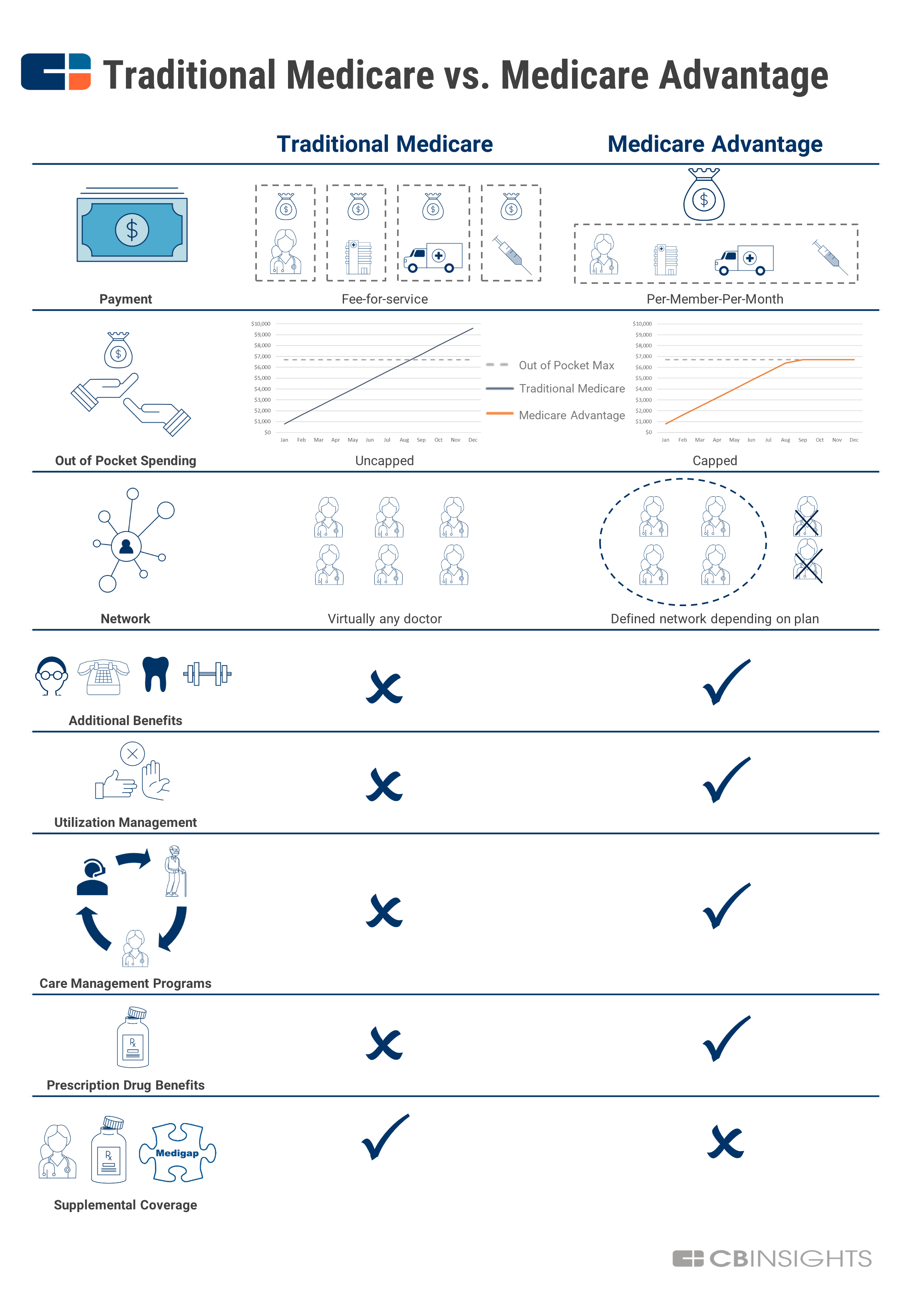

Insurance coverage constraints Many plans restrict your protection to specific physicians as well as centers. You might occasionally have waiting periods for the care of pre-existing problems. The majority of wellness insurance policy will certainly not cover optional procedures or new treatments.

Not known Factual Statements About Health Insurance Tampa Fl

Increasingly, wellness plans are counting on more limiting service provider networks to regulate both use of services as well as prices, resulting in restricted provider choices for the customer. Health insurance policy can come up short in various other ways.

Job-based plans can enforce a waiting period of 18 months on some pre-existing problems for a late enrollee (a worker that has enlisted in a strategy after the initial enrollment duration). In some circumstances,. For instance, the plans determine which services are provided, which ones are covered as well as exactly how much the insurance policy will certainly pay.

Some Known Factual Statements About Health Insurance Tampa Fl

And many medical insurance will certainly not cover optional procedures, brand-new technologies or off-label substance abuse prescriptions utilized for an illness or condition the medicine is not accepted to deal with. Some insurance provider proclaim the benefits of, stating they are less-expensive choices for the uninsured. Yet these strategies are not long-lasting services.

They are not called for to cover preexisting conditions, as well as they can refute protection entirely based on clinical conditions. And since many plans have a really high deductible, a lot of enrollees can still have try this high costs for their medical treatment. As the name suggests, short-term strategies are best for short-lived insurance coverage, normally offering insurance coverage for a year or much less, bridging voids in protection.

Everything about Health Insurance Tampa Fl

Thankfully, there are reasonably inexpensive as well as extensive insurance policy options readily available. If you are utilized, among the starting points to seek insurance is with your company. Many people in the USA acquire wellness insurance with employer-based plans, which are fairly inexpensive since employers add to the price of the strategies.

Though eight states allow young people to stay on even additionally. The Medicaid program provides detailed wellness insurance to adults and also families who have very reduced incomes, making it the very best program for. There is little or no charge for Medicaid, but recipients are called for to fulfill particular income and also qualification needs to certify.

Examine This Report about Health Insurance Tampa Fl

Yet the benefits much surpass the drawbacks. Health and wellness insurance makes healthcare a lot more affordable as well as a lot more easily accessible, hence aiding us remain healthy and balanced as well as eventually live longer lives. Nevertheless, medical insurance can be costly, you'll still have some prices for healthcare and also strategies can have insurance coverage constraints.

Things about Health Insurance Tampa Fl

Having medical insurance has many advantages. It protects you as well as your family from monetary losses similarly that home or cars and truck insurance coverage does. Also if you are in healthiness, you never ever know when you may have an accident or obtain unwell. A trip to the health center can be much a lot more costly than you may expect.

1 A busted leg can set you back up to $7,500. Ordinary costs for childbirth are up to $8,800, as well as well over $10,000 for C-section shipment.